- Drop Your Stocks and Grab your SOX Charts

Rotation to Semiconductors?

- Current Series I and EE Savings Bond Rates

Nov. 1, 2013 to April 30, 2014

| Subject: | MORE – Re: American Propaganda: "Rising Home Prices Are Benefiting Everybody" |

|---|---|

| Date: | Tue, 12 Nov 2013 08:27:50 -0800 |

| From: | Jas Jain |

MORE – Re: American Propaganda: "Rising Home Prices Are Benefiting Everybody"

Lando: "Oh, come on! Again the same slogans? Are these morons using the same tricks of few a years ago? Dopes have no memory. Amazing."

The same Chief Economics Editor for Bloomberg was trying to buttress the case that QE is helping the economy and "everybody" in the process. He explained that the primary tool, or mechanism, that the Fed uses to help the economy is via rising stock prices and rising home prices, i.e., "the wealth effect." The magical powers of Asset Inflation! Therefore, the best measure of the success of the Fed policy is: how much have stock and housing prices gone up

He did admit that rising stock prices now, as opposed to late 1990s, mostly help the wealthy. Then he threw in the line that appeals to born-and-bred American dopes: "Rising tide lifts all boats." The same old trickle down economics from the Reagan Era. What has actually happened since 1980s, and most evidently since 2008, is more like trickle up poverty. Just wait for the next recession and the trick up poverty would become jumping up poverty with 30-40% of Americans receiving Food Stamps. It couldn't happen without the help of born-and-bred American dopes who have no understanding of the underlying causes and incessantly engage in partisan blame game.

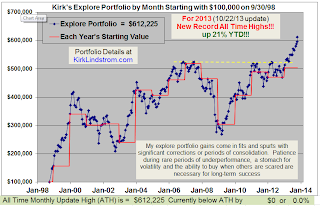

Jaswith "Kirk Lindstrom's Investment Letter"

(Your 1 year, 12 issue subscription will start with next month's issue.)

No comments:

Post a Comment