-------- Forwarded Message --------

| Subject: | Stock Market Update: S&P 499 and NASDAQ-99 Peaked 15 Months Ago |

|---|---|

| Date: | Sat, 19 Oct 2019 16:49:22 +0000 |

| From: | Jas Jain |

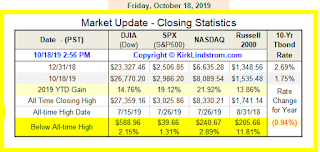

MSFT has 4.2% weight in S&P 500 and 8.12% in NASDAQ-100. All the gain and more in these two major indexes for the past 15 months are due to 35% gain in MSFT. All the gains in DJI, S&P 500, and NASDAQ-100for the past 21 months have been due to four stocks, $MAGA.

Stock Market Had Become a One-Trick Pony and That Pony Is Now Balking

MSFT highhandedly carried S&P 500 to a marginal new high adding 250 points of gain to the index this year alone. Approximately 10% of the gain in S&P 500 this year was due to MSFT, an amazing pony that raced to exhaustion. That pony today refuses to carry the weight and move forward.

Broad market peaked 17 months ago and four $MAGA stocks, or a 4-mule wagon, kept the market from entering bear market. One by one these mules, or ponies, balked until only one was left carrying the load in 2019. Three of these $MAGA stocks hit the trillion dollar market cap; first, Apple, then Amazon, and recently Microsoft. It has proven to be the kiss of death.

Fed rate cut is coming soooooooooon and that might prove to be Coup de grâce. Hoping that Trump would be able to save the market and the economy is fanciful dreaming, or dopey thinking.

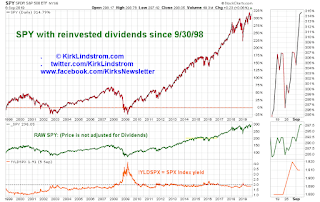

History Rhyming

In 2000, three stocks, CSCO, MSFT, and INTC, hit market cap close to $600B and that proved to be the kiss of death for the three stocks and the market. Market caps of CSCO and INTC now are $250B and $210B, respectively, and MSFT has backed off the $1Tr mark. Even MSFT, the most successful of the three, has significantly under-performed the long-term US Treasuries since the market peak in 2000! Recommending US Treasuries to those addicted to stocks is a bad idea.

My long-standing target of 500 for S&P 500 would be realized in the next few years. Only a small % of people who have been in stocks for the past 25 years will get out of stocks with any gain. Those who make offerings to the Crooks deserve their just rewards.

Jas