Nov. 21 Charts: -------- Original Message --------

"Deflation Disaster"

My friend George Ure is warning his readers about the "deflation disaster." Why would anyone worry about paying less for things? It is something that people should cheer about, but George runs his website for bears who see all positive developments as a bad. Hey, George, send the money you save by paying less for things to charities. I have been enjoying deflation for the past few years like a drunken sailor by switching to higher quality Scotch whiskey, aged 18-24 years, and Cognac at very good prices. Costco carries few of them.

Economist fraudsters like Ben Bernanke, Paul Krugman, Ken Rogoff, etc., have perpetrated this whole idea that deflation is bad. Of course, we have created a bad econo-political system that can't deal with the good thing, but why should we continue a bad system? A People's economist like yourself should know that America had a huge period of deflation, 1871-1900, during which it rose the top of the world in terms of production displacing France, Germany and the UK. Deflation is bad for the Crooks and good for the vast majority of workers. It is very bad for all the fraudulent schemes of the govt that didn't exist in the nineteenth century US of A. So, George, whose side you are on, Crooks and bad govt schemes or the workers?

Three cheers for deflation! And it is coming to America and most of the civilized world sooner than you think, as I have been telling people for the past several years. Fed can't help but lose the fight against deflation. It is the weak demand, stupid! Soon you would find out who understands the US economy better.

Jas From: GB

Subject: Re: "Deflation Disaster"

Date: Thu, 21 Nov 2013 15:08:15 -0500

To: jas_jain

Jas,

Disinflation is great, but deflation is pretty scary.

Scary like some imaginary witch is going to get you?

You can't cut people's salary (as a practical matter)

First, if the prices fall 1-2% there is no need to cut salary as long as worker's productivity is growing at 2%. But, if prices fall further and people are being laid off any thinking worker would be happy to keep the job and take appropriate cut in wages. As an American you are being unpractical here. For the Indian govt that may be a problem (strikes!) but for any practical man it is no problem whatsoever. Practical men deal with reality in a practical manner. Americans have dealt with deflation in the past and they might have to put their thinking caps and deal with it now.

but a business owner must lower his prices.

Yes, whatever the market would bear. IF you can't make a profit for a long enough time then you shut the business down and do something else.

Haven't you seen prices of many goods being lowered… Soon the company fails, and everyone is thrown out of work.

Nonsense. Companies fail even in areas where prices are going up. Failure has to do with not being able to adjust to the reality. It has absolutely nothing to do with falling prices, e.g., computers, TVs, etc.

Now aggregate demand is less, and even more companies fail.

No one guarantees demand of anything. You go where the demand is. Sometimes people need to learn to live with less. It is a good thing and not bad except for few things of necessity. We are way beyond necessities in terms of the aggregate demand.

The cycle flushes the whole system down the toilet.

Yes, at times toilet needs to be flushed! It is a very good thing. Then we begin with a clean toilet, or a clean slate.

Falling prices only work if you have a job and an income to spend. I agree with much of what you have written over the years, Jas, but as a business owner, I can tell you that cutting salaries is very difficult.

That is why people need to save, have a cushion, and your ancestors and mine have done it for hundreds of years. I am quite sure that you come from a good stock.

Jas

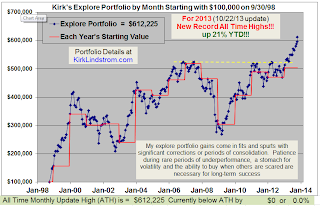

Kirk's Nov 20 Graph: