To the knuckleheads also known as Cisco System's board of directors,

Are you aware that $1B of insider selling needs the equivalant 1,000 investors investing $1,000,000 each to offset the selling pressure?

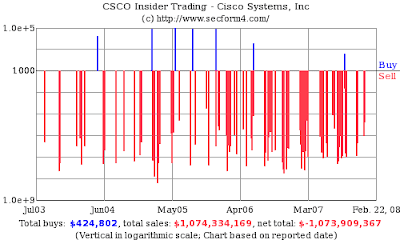

Click this chart below from the SEC Form 4 Sec Filings for Cisco Insider Trading and Stock Options to see the full details.

Insiders sold enough shares to create 1,000 millionaires!

I owned Cisco stock in the past for a nice ride from $17 to $24. I sold it after the ride as I thought there were other companies who were far more "shareholder friendly."

These days many technology stocks, such as yours, are way off their 2000 highs so I am again taking a look at Cisco Systems for potential purchse.

Before I buy Cisco, I would like to know:

- Why should I invest my hard earned money into a stock where the insiders have sold nearly billion dollars worth of shares with only $424,802 in purchases?

and

- Are all you insiders waiting for the "3-gap-play" to buy at $17.50?

- If so, why wasn't there a mad rush of insiders buying at $17.50 the last time the stock was that low?

Maybe I will join you in buying at $17.50 if there is a rash of insider buying greater than insider selling. Otherwise, I may buy shares in companies where insiders have more confidence for the long term.

Maybe I will join you in buying at $17.50 if there is a rash of insider buying greater than insider selling. Otherwise, I may buy shares in companies where insiders have more confidence for the long term.

Compare Cisco to Valence (VLNC), a company I have dollar cost averaged into since selling my Cisco stock. Valence has nothing but insider buying.

Funny thing: I've made money on the Valence! This seems to confirm that insiders know real value and will invest their own money accordingly.

I have a hard time resisting a GREEN company with great growth opportunity when insiders are putting their own money into the stock rather than cashing in low priced options.

For more on Valence, see my articles "OEMtek Uses Valence Batteries for 100 MPG Prius Conversion" and "Valence Technology: A Green Stock with Potential."

Feel free to send me a note when you insiders at Cisco Systems start buying your own shares again using your own money rather than shareholder money.

Disclaimer. I have been accumulating Valence in my newsletter and personal portfolios and have very good profits already at the current price of $2.97. I plan to continue to trade around this core position in an attempt to increase my overall return. I expect Valence to be a very volatile stock.

No comments:

Post a Comment